Interest/Mortgage Rates Report for February 2024 – UPDATED

Although the average rates on 30-year mortgages moved up slightly, forecasters still see an eventually decline by the end of the year.

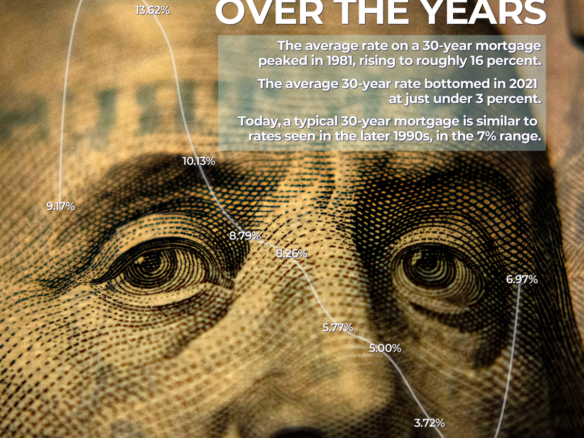

The average rate on a 30-year mortgage rose to 6.77% from 6.64% last week, says Freddie Mac. Year to date, the rate averaged 6.32%.

As of February 2024, US interest rates right now: The Federal Reserve keeps key rate unchanged at about 5.4%, a 22-year high which signals cuts are likely months away. Now without going into all the details, many economists think that interest rates might not come down until June.

The cost of financing a home recently since the average rate on a 30-year mortgage hit 7.79%, the highest level since late 2000 (Source: FloridaRealtors).

But REMEMBER that MIAMI is a special localized market where we did not experience the national slump due to our influx of population, large numbers of international & domestic investors and emerging world prominence. The Miami market has stabilized and remained level the past 6 to 8 months.

For now, the average rate on a 30-year mortgage remains sharply higher than just two years ago, when it was 3.55%. Also keep in mind that 80% of home/condo sales happen from MARCH to SEPTEMBER.

That means, right now the smart buyers are buying as overall inventory is still tight, many properties are selling below listing price and there are not yet as many buyers thus meaning less competition which will drive up the prices.